What are FBAPS?

FBAPS is the acronym for a group of leave types – family violence leave, bereavement leave, alternative holidays, public holidays and sick leave. The reason they get their own group and annual leave is out on its own, is because FBAPS all use relevant daily pay and annual leave doesn’t. You can learn all about annual leave in this post.

Let’s get into it!

Family violence leave

Family violence leave is a separate leave type allows employees to take time off work if they or their dependents are affected by domestic violence. Employees can take up to 10 paid days off per year once they have worked for an employer for 6 months for an average of 10 hours per week and at least 1 hour in every week of 40 hours every month.

If more than 10 days is needed, an employer can offer more than the minimum or allow the employee to take annual leave, unpaid leave or family violence leave in advance.

If an employee does not use their 10 days of family violence leave, this does not roll over into the next year.

Bereavement leave

Bereavement leave is available for eligible employees to take time off to grieve and handle matters if someone close to them dies.

All employees, including casuals are entitled to 3 days bereavement leave, per bereavement. in the following circumstance

- Death of an immediate family member (ie. parent, partner or spouse, child, sibling, grandparent, grandchild, parent-in-law)

- The employee experiences a miscarriage or stillbirth

- Another person has had a miscarriage or stillbirth and the employee:

- Is the person’s partner

- Would have been the biological parents of the child who passed away

- Was due to be the primary carer of the child who passed away

- Is the partner of a person who was due to be the primary carer of the child

Employees are able to take bereavement leave for a minimum of 1 day on the death of any other person and the employer accepts they’ve had a bereavement based on:

- How close the employee was with the deceased person

- Whether the employee has a lot of responsibility for any of the arrangements for the ceremonies relating to the death

- If the employee has any cultural responsibilities in relation to the death

Employees are entitled to bereavement leave if they have worked for an employer for 6 months for an average of 10 hours per week and at least 1 hour in every week of 40 hours every month.

If an employee has not met the minimum requirements and does not qualify for bereavement leave or wishes to take extended bereavement leave – the employer can agree they can take leave in advance, annual or unpaid leave. Employers may also choose to give employees additional bereavement leave above the minimum entitlement.

Alternative holidays

An alternative holiday is a paid day off that employees can take at a later date. These are only received when an eligible employee has worked a public holiday.

Employees are entitled to an alternative holiday when they work, or are on-call and have to restrict their activities, on a public holiday that is a usual working day for them.

No alternative holidays will be given if an employee works a public holiday that would not be a normal working day for them or on-call but do not need to restrict activities.

Alternative holidays can be taken by the employee on any day that is agreed with their employer and can be cashed up after 12 months if it is not used, if the employer agrees. Alternative holidays do not expire and will be paid out in an employee’s final pay if they are not used before their employment ends.

Public holidays

There are 11 public holidays per year in Aotearoa New Zealand and 1 holiday per region (regional anniversary day) which all employees can be entitled to if the public holidays falls on a day they would usually work – an otherwise working day for the employee. Lets unravel this…

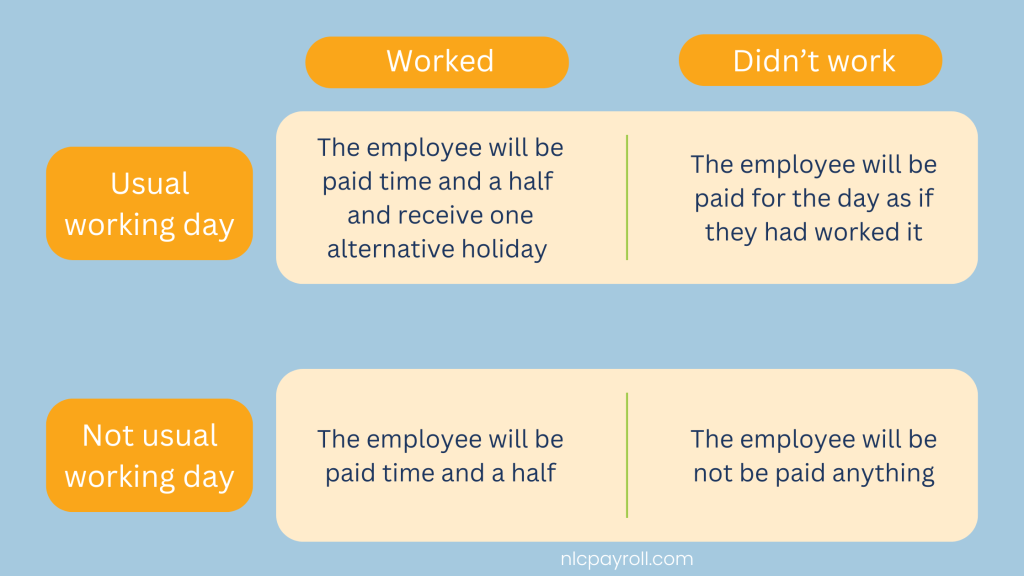

If an employee works on a public holiday and it is their usual (i.e. the employee would otherwise, if not for the public holiday, work this day) working day, the employee will be paid time and a half and receive one alternative holiday to be taken at another time.

If an employee works on a public holiday and it is not their usual working day, the employee will be paid time and a half.

If an employee does not work, but due to some of the reasons below, would be an otherwise worked day, the employee would be paid for the public holiday.

- Due to business closure for the public holiday

- They took paid leave over the holiday (Annual leave, other FBAPS)

- As a variable employee, shows a pattern of working this day 50% or more of the past 4 to 13 week period

Sometimes public holidays can be attached to a specific date which means they can fall on a Saturday or Sunday. In this case the public holiday will be observed on the Monday – which will only occur if the employee did not work the Saturday or Sunday.

Depending on where an employee is based, they will also receive the same benefits for their local anniversary day.

Sick leave

All employees including part time and casual, are entitled to 10 days of sick leave per year once the employee has worked for the employer for 6 months for an average of 10 hours per week and at least 1 hour in every week of 40 hours every month.

If an employee has no sick leave left, they may use annual leave, unpaid leave or use their sick leave in advance – if agreed by the employer.

Any unused six leave may be carried over to the next year up to a maximum of 20 days. Sick leave is unable to be cashed in and remaining sick leave isn’t paid out in an employee’s final pay.

How are FBAPS calculated?

Under the Holidays Act 2003, payment for FBAPS is paid using either Relevant Daily Pay (RDP) or Average Daily Pay (ADP). RDP is the amount an employee would have earned on the day leave is taken, including wages, overtime if this would have been worked on the day, and any other like payments. ADP, on the other hand, is used when it’s not possible or practical to determine RDP, such as for employees with variable hours. ADP is calculated by combining the employee’s gross earnings over the past 52 weeks, divided by the number of days worked for the same period. Employers should use RDP whenever possible but switch to ADP if calculating RDP is difficult or unfair.

We are pros at navigating the complexities of leave and keeping you compliant! Contact us and see how our personalised outsourced payroll team can help.

Contact Us

Disclaimer: The information provided in this article is for general informational purposes only and is not intended as a substitute for professional advice. Reliance on the information in this article is at your own risk, and it should not be used as a basis for making decisions without consulting a qualified professional.