The festive season is just around the corner, and we know there can be a lot to juggle during this time. For businesses and HR teams Christmas Payroll is likely to be front of mind and there can be a lot to keep track of with public holidays, annual leave and the odd Christmas party to factor in.

Here are some things to consider to help make your December smooth sailing.

Make a plan, and make it early

Everything seems to ramp up before Christmas, and by having a plan in place early, you don’t need to worry about adding payroll to that list.

Many businesses have slightly different pay schedules during this time due to closure, leave and public holidays. You’ll want to get your payroll sorted earlier than usual to account for these changes and make sure your system is configurated with the public holiday dates.

Have a think about what days you’ll be open, if any and what staff requirements you’ll need.

Check in with your leave calendar, who’s planning on being away and for how long? If your Payroll Pro is away, can the pay run be automated ahead of time or do you have cover for them?

Keep track of annual leave

This is a great start to planning Christmas leave, everyone would like to know how much leave they have available to take during this period! Now is the time to know what employees are entitled to as everyone will have different entitlements and leave balances. Also a good time to check all balances are up to date in your system.

Keep everyone in the loop

Are you open as usual or closing your doors for the festive season? Make sure employees know what the plan is, and any changes to pay dates. Clear communication is key to minimising any payroll confusion.

Working the holidays?

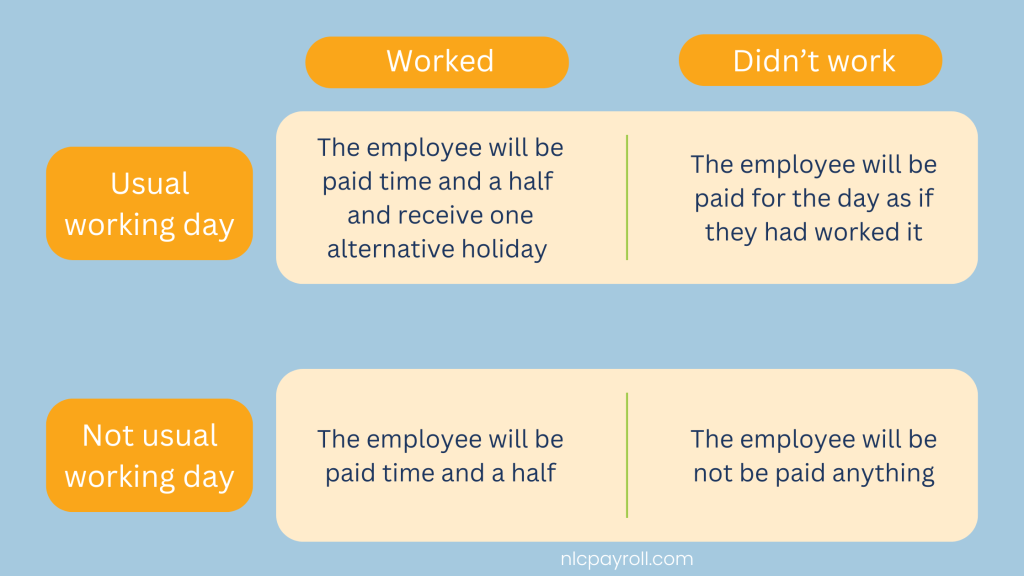

If your employees are working the public holidays it’s important they are paid properly.

If an employee works on a public holiday and it is their usual (i.e. the employee would otherwise, if not for the public holiday, work this day) working day, the employee will be paid time and a half and receive one alternative holiday to be taken at another time.

If an employee works on a public holiday and it is not their usual working day, the employee will be paid time and a half.

If an employee does not work, but due to some of the reasons below, would be an otherwise worked day, the employee would be paid for the public holiday.

- Due to business closure for the public holiday

- They took paid leave over the holiday (Annual leave, other FBAPS)

- As a variable employee, shows a pattern of working this day 50% or more of the past 4 to 13 week period.

Thinking about a bonus?

You might be considering paying a Christmas bonus this year – here’s some tips to make sure you stay compliant.

When using a payment code in your payroll system, make sure it’s setup correctly. A bonus payment should be taxed as lump sum / extra pay tax, so be sure to check the tax settings of the code used. If this payment isn’t contractual, it could probably be excluded from average earnings too.

Christmas payroll doesn’t need to be tricky, being organised is the key! If you find yourself in a bind leading into the silly season, get in touch!

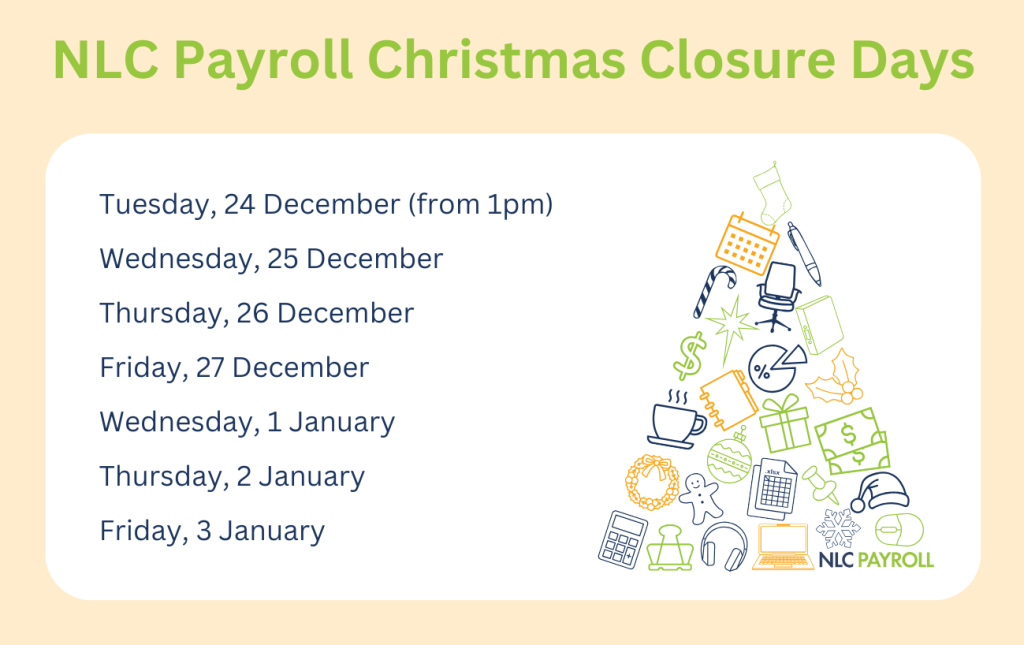

We’re taking a break this year

Disclaimer: The information provided in this article is for general informational purposes only and is not intended as a substitute for professional advice. Reliance on the information in this article is at your own risk, and it should not be used as a basis for making decisions without consulting a qualified professional.