ACC Earners’ Levy

In America if someone has an accident the first words they hear are “do you have insurance?” In NZ you’re more likely to hear “are you ok?” This is thanks in large part to ACC. In NZ we all pay an ACC levy as part of our income, petrol, car rego or business. This money is used when New Zealanders have non -work related accidents in which ACC helps pay for their care and recovery. This levy is currently set at $1.39 per $100 of liable earnings and collected by IRD on behalf of ACC. For most of us this levy is automatically deducted from our pay.

ACC sets the minimum and maximum levels of liable income for levies on April 1 every year. There is an increase in the maximum liable earnings that businesses and the self-employed pay work account levies on in the 2020/21 financial year. This will rise from $128,470 to $130,911. The minimum liable earnings that self-employed people pay Work and Earners levies is $36,816 in 2020/21, this is in line with the minimum wage increase.

Minimum Wage increase

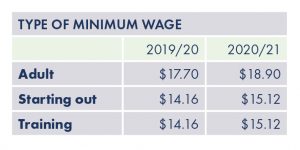

From 1 April the minimum wage will increase by $1.20 per hour to $18.90, keeping in line with the Governments plan for a $20 minimum wage by 1 April 2021.

This means for an adult working 40 hours per week their gross weekly earnings will increase from $708 to $756, an increase of 6.8%. The starting out and training wages will increase by $38.40 (gross) per week for a 40-hour week.

This means for an adult working 40 hours per week their gross weekly earnings will increase from $708 to $756, an increase of 6.8%. The starting out and training wages will increase by $38.40 (gross) per week for a 40-hour week.

FUN FACT: The Minimum Wage Act 1983 requires the starting out and training wage, be no less than 80% of the minimum adult wage

Employers will need to advise the employees of this change in writing. The ripple effect from this increase can be both positive and negative for employees and employers alike. Staff hours could be cut, consumer goods prices could be increased, and others will have more disposable income, which leads to increased consumption levels. Poverty rates can also be slightly affected, especially for those without children, allowing them to break from the poverty trap. Other factors such as Working for Families will also assist these groups.

So, if you are an employee and your hours will remain the same, start thinking about what this increase means for you and how you can capitalise on it. We all have grand plans for what we’ll achieve with a pay rise, but if they’re not planned for, the money can easily get eaten up in day to day living. Perhaps this extra money could be put aside to pay down debts, put aside in savings, turning the heat on in winter, or finally get that questionable rash seen to. Don’t underestimate the power of a few extra dollars, when used wisely you’ll really make your money start working for you.

As an employer, while cutting staff or their hours is an option, look at what other cost saving measures can be taken into consideration before resorting to this. Something as simple as researching a better power provider, sticking to a business budget, using energy efficient appliances, asking for prompt payment discounts, buying used equipment and furniture where appropriate are all great ways to take back control of your spending. Be honest with yourself about what is a need and what is a ‘nice to have’. Most of us know the cost saving story from 1987, where American Airlines saved $40,000 in one year just by removing one olive from each passenger’s salad. Small penny-pinching strategies can have long reaching effects. Don’t be afraid to get creative…not illegally creative, just creative.

Increase to Student Loan repayment thresholds

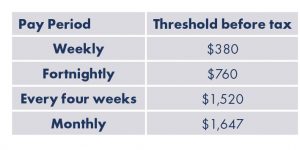

You’ve finished studying and now starting out in “the real world”, or perhaps you’re hiring staff that have student loan obligations. In the 2020/21 year the student loan threshold (the income level in which you are required to start paying off your student loan) will increase from $19,760 to $20,020. The repayment rate remains at 12% of every dollar you earn over the repayment threshold.

To put this into context, if you earn $700 a week before tax your repayment will be $38.40

To put this into context, if you earn $700 a week before tax your repayment will be $38.40

Workings: $700 (week) – $380 (threshold before tax) = $320.

12% (rate of repayment) of 320 = $38.40

To check your student loan balance log onto myIR.

Name change: Special Tax Code (STC) now called Tailored Tax Code

If you could change your name what name would you choose? Well the Special Tax Code has chosen Tailored Tax Code to begin the 2020/21 financial year. I like it, it’s more refined…like me.

A tailored tax code helps people pay the correct amount of tax when they get paid, saving them a large tax bill at the end of the year (always a good thing). Tailored tax codes are helpful when an employee;

- has more than one job

- has business losses to carry forward from a previous year, and is now earning wages or salary

- is receiving a benefit or ACC and working at the same time

- is receiving an overseas pension that is taxable in New Zealand

A tailored tax code or tailored tax rate application (IR23BS form) is required then an employee will be issued with a special tax code certificate to inform the employer what tax deductions to make.

For more information on the special tax codes check out the article from business.govt.nz by heading to www.business.govt.nz/news/special-tax-codes-and-deduction-rates-what-to-do/

If there’s a subject you’d like us to explore further, then please let us know by using the ‘Message Us’ button on the right we’d love to hear your thoughts.