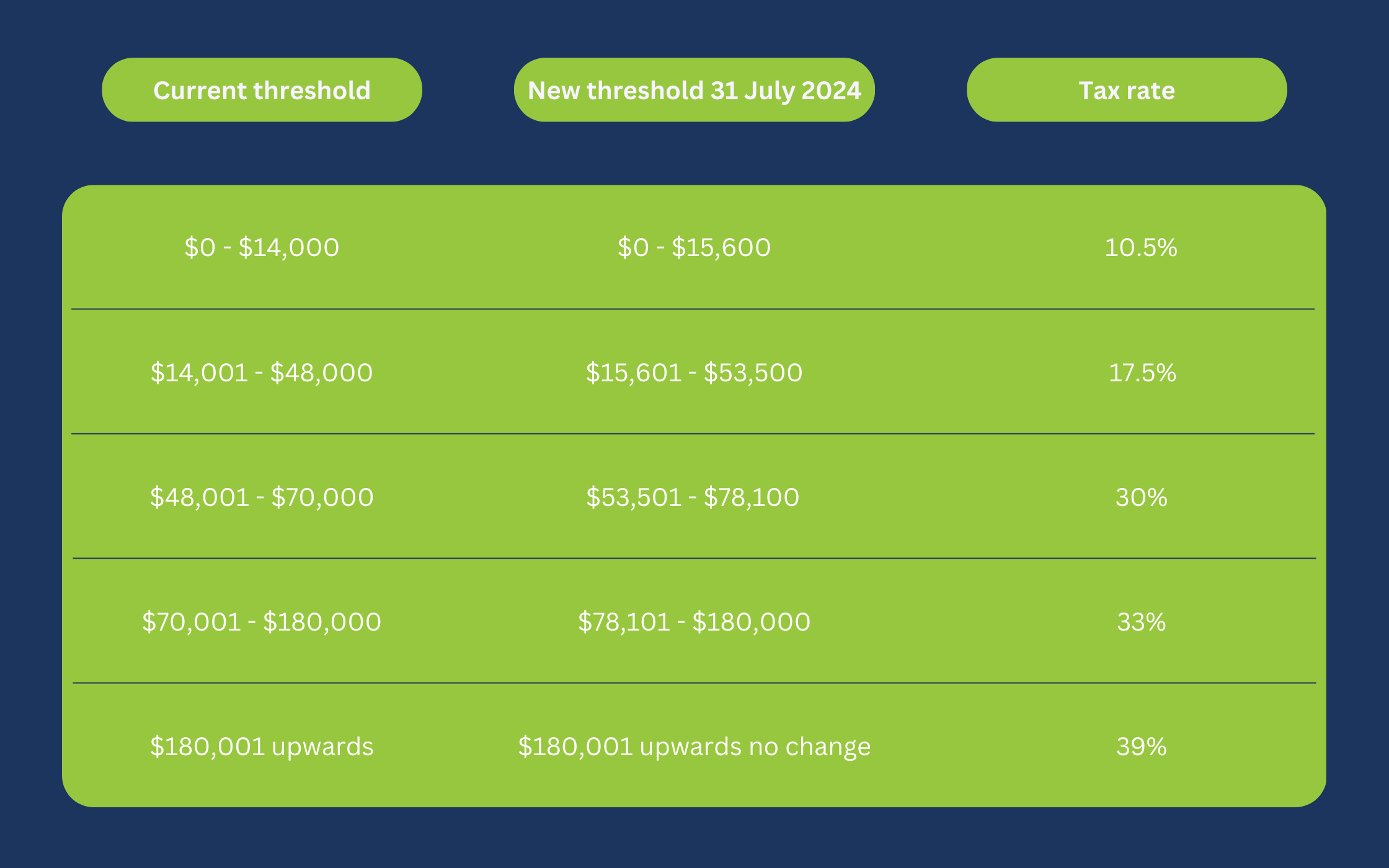

The personal income tax thresholds are changing on 31 July 2024 meaning most employees will be taxed slightly less.

How does this impact payroll?

The easy news is that if you are using a payroll system, there’s nothing that you need to do – your payroll software provider would have updated your systems.

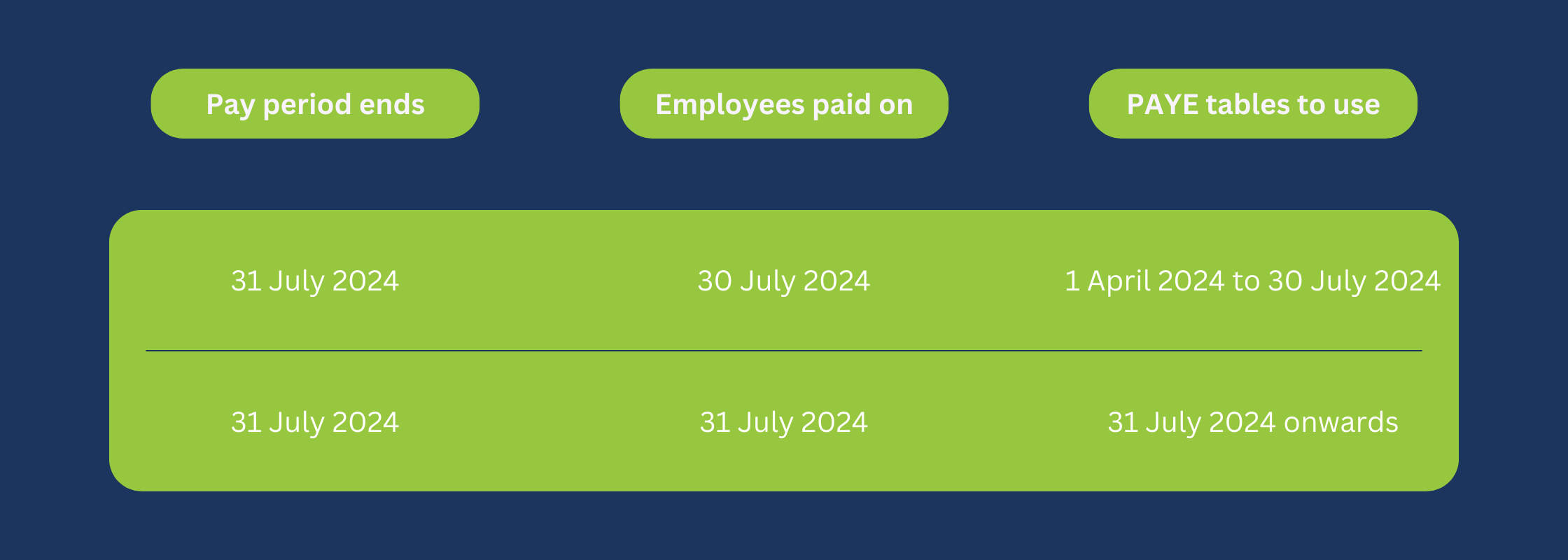

The cutover to the new thresholds depends on the date of payment, and will work like the below:

If you aren’t using payroll software (or make system changes yourself), make sure you’re using the new tax tables in your calculations. The new tax tables and tax code declaration IR330 can be found on IRD’s website.

PAYE extra pays

Until 1 April 2025, for extra pay calculations use the personal income tax thresholds 1 April 2024 to 30 July 2024. Using these rates means less chance of people getting a tax bill at the end of the tax year.

Let us handle your payroll, it’s what we do best. Get in touch to see how we can simplify your pays!

Contact Us