Just like that, it’s 2025! Some of us are back to work daydreaming about the next holiday break, preferably one with sun this time (looking at you, Wellington).

Whether your team works on public holidays or not, there are rules and regulations you need to know to make sure everyone is paid correctly. Let’s break it down simply so you can get it right every time – we’ve put together a quick guide to Public Holidays and Regional Anniversary Days for 2025:

Prepare your calendar

Setting your calendar up with public holidays and anniversary days sets you up for success with payroll planning. Public holidays are likely to be recorded automatically in your payroll software.

If you have staff across the country this will help to keep track of which different anniversary days they will fall under.

If the full-time employee is usually based in Auckland, but is temporarily based in Wellington, the Anniversary Day to be observed is to be agreed by the employer and the employee, but the employee can only claim one Anniversary Day per year.

Both parties can agree to transfer the observance of the public holiday if they wish. If they cannot reach an agreement, then the employee is entitled to observe the anniversary of the province that they usually work in (Auckland, in this example). If they were to work on the day, they’d be paid time and a half, plus an alternative day.

How do you pay employees on public holidays?

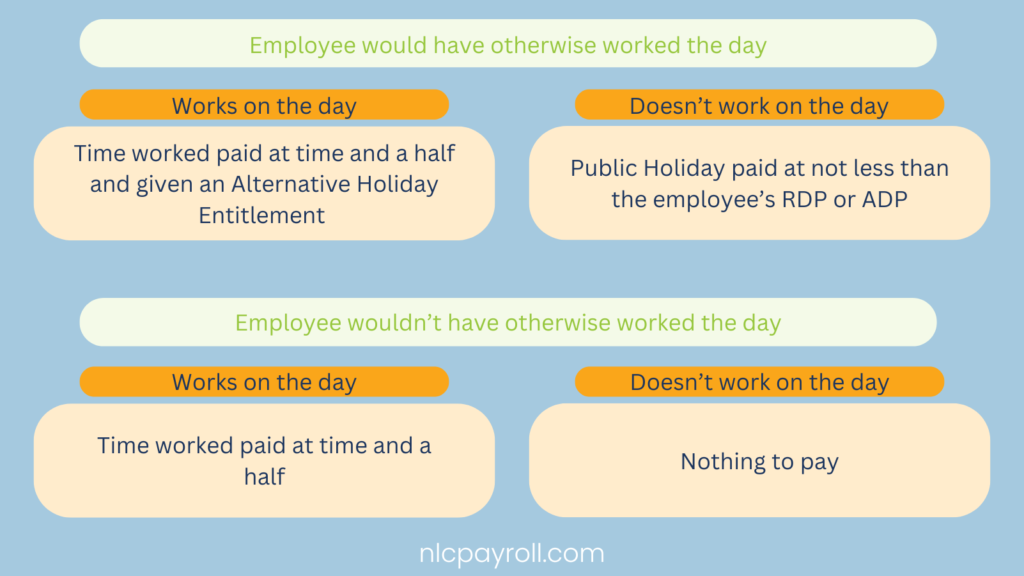

When it comes to paying employees on public holidays, there are a few different rules, depending on whether your staff work that day or not. Here’s the basic breakdown:

If an Employee does not work the public holiday they’re entitled to a paid day off if the public holiday falls on a day they would normally work. This is paid at the employee’s “relevant daily pay” (RDP) or “average daily pay” (ADP) if RDP is not possible or practicable to calculate.

Employees required to work on a public holiday must be paid time-and-a-half pay for their hours worked.

Additionally, if an employee works on a public holiday that would otherwise be a working day for them, they must receive an Alternative Holiday Entitlement in addition to their pay. This alternative holiday is taken on a mutually agreed-upon day and is paid at the employee’s RDP or ADP.

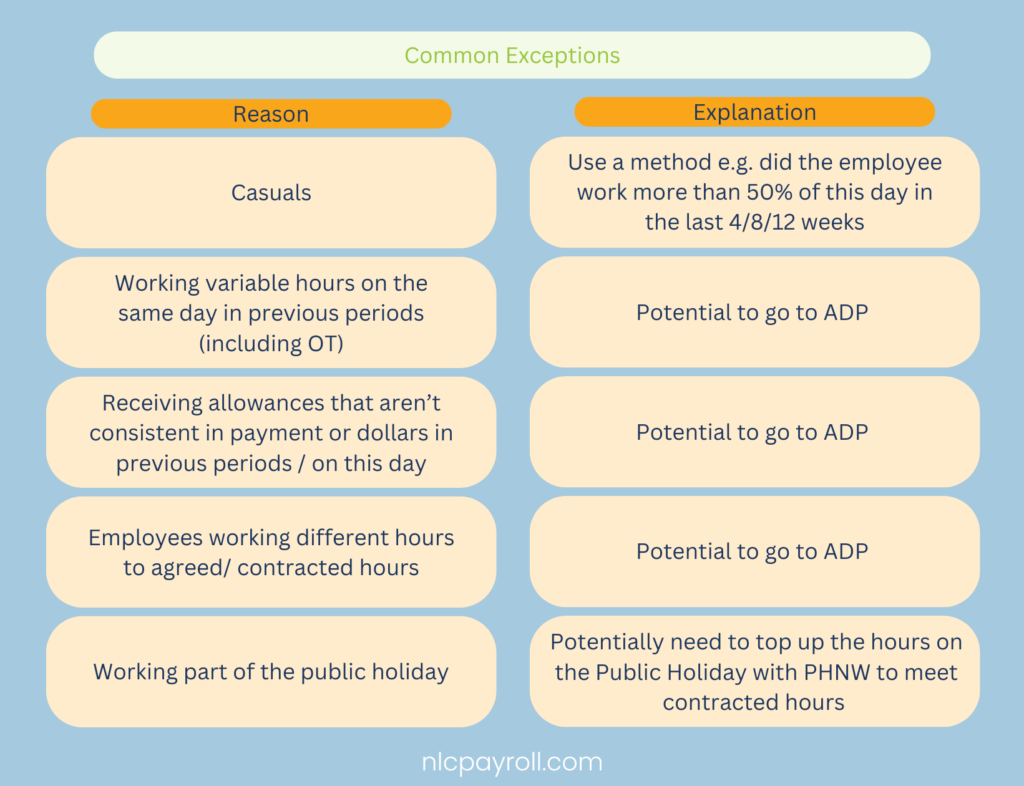

What about shift workers or casuals?

Working out public holiday entitlements for shift workers can get a bit complex. If an employee works a shift on a public holiday they will receive time and a half for the hours they work. If they would have ordinarily worked that day they will also be entitled to an alternative holiday.

Here are some common exceptions:

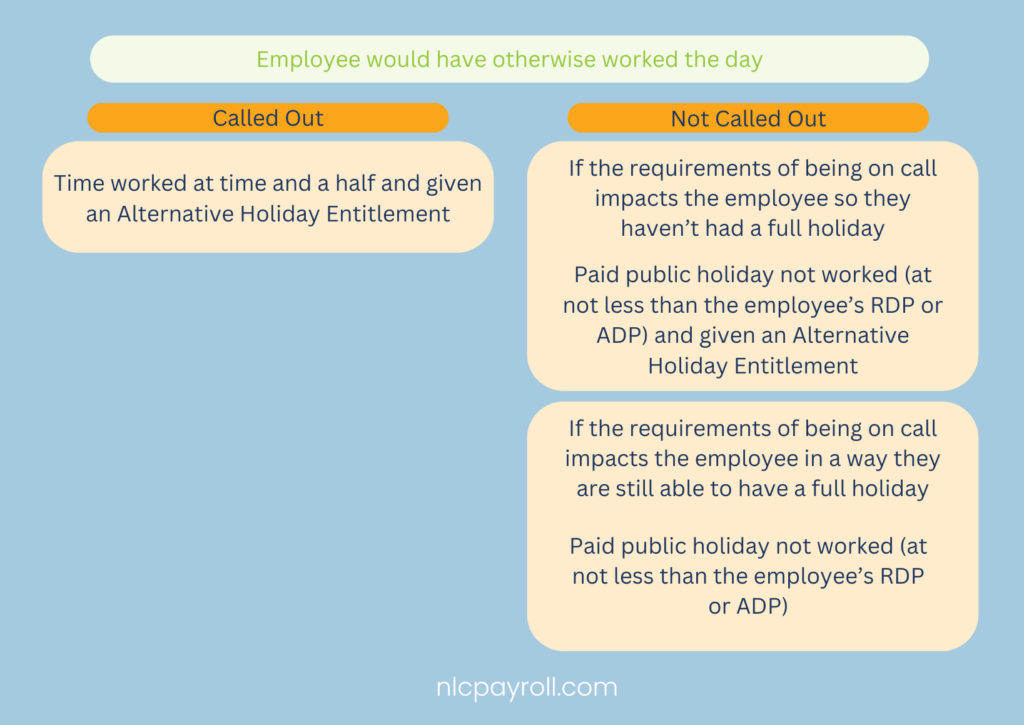

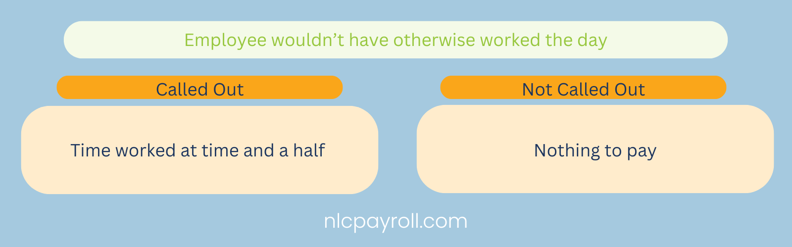

For on-call employees, the public holiday entitlement will depend on the type of arrangement you have with that employee. Usually, public holiday entitlements would apply if the employee was unable to enjoy a full holiday due to their on-call requirements. If in doubt, pay time and a half for being on call if there are restrictions.

What exactly is an ‘otherwise working day’?

An otherwise working day is a day an employee would have been working had there not been a public holiday or any leave taken. This can be pretty easy to define if the employee has set working days or roster, but gets a bit harder to work out when an employee works varying shifts or casually. In this case its up to the employer and employee to come to an agreement.

What happens if the public holiday falls during a leave period?

If an employee is on leave (annual leave or other FBAPS) and a public holiday falls during that period, the employee will be entitled to be paid for that public holiday if it is an otherwise working day for them and not be deducted other leave types.

Mondayisation

If a public holiday falls on a Saturday or Sunday, the public holiday is moved to the following Monday (or in some cases Tuesday if there are two consecutive holidays). This is known as Mondayisation.

Paying public holidays is a little complicated and can take the fun out of an upcoming break for your payroll team. The good news is we know this stuff inside and out – chat to us about outsourcing your payroll, we’d love to hear from you.

Get in touch

Disclaimer: The information provided in this article is for general informational purposes only and is not intended as a substitute for professional advice. Reliance on the information in this article is at your own risk, and it should not be used as a basis for making decisions without consulting a qualified professional.