Annual leave is an entitlement for all employees in New Zealand, giving people the opportunity to rest, recharge and enjoy time away from work!

Sometimes it can be tricky to navigate entitlements, calculations and best practice, so we’re breaking down the details under the Holidays Act to make it easier to understand.

What is Annual Leave?

Annual leave, also known as annual holidays, is the paid time off that employees accrue based on their length of service with an employer. In New Zealand, employees are entitled to a minimum of 4 weeks paid annual leave when they have worked for an employer continuously for 12 months.

Employers can give employees more than their minimum entitlement of annual leave and allow employees to take annual leave in advance.

An employee’s annual leave balance does not expire, the employee is entitled to their annual leave until they take the holidays, cash them up or their employment ends and they are paid out for them.

What about casuals?

Casual employees are entitled to annual leave, just like all other employees. As they don’t have set hours, the employer can agree with the employee that they will pay them an extra 8% of their salary or wage each pay instead of earning annual leave.

Employers need to be careful about having casual employees who begin to work regularly, or a fixed pattern. If a casual employee works regularly for more than 12 months, they are likely due a 4-week annual leave entitlement, regardless of having been paid 8% per pay.

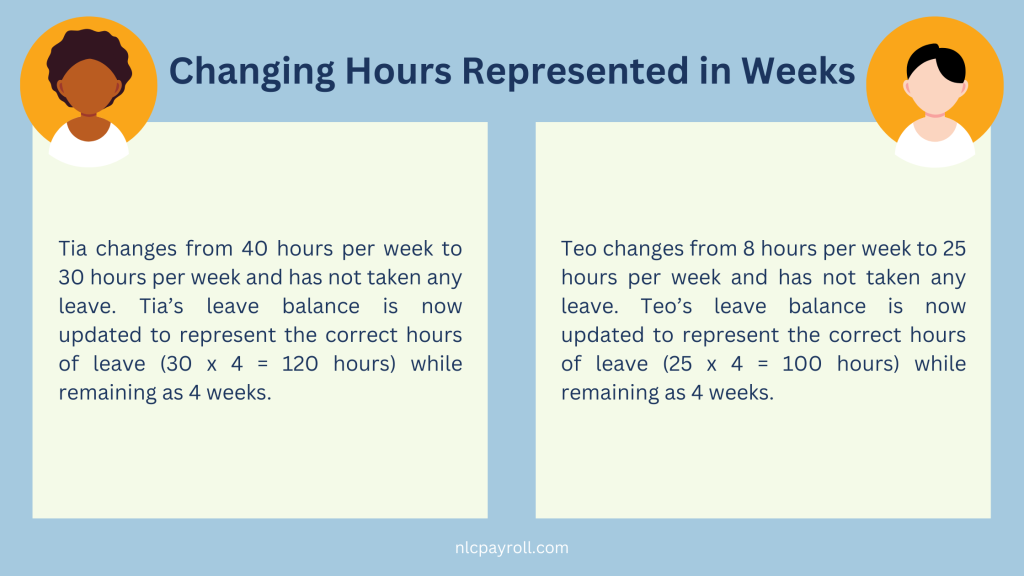

What happens if an employee changes FTE?

When annual leave is recorded in the payroll system as weeks (as per the Holidays Act), an employee changing their work hours is easily managed – you do nothing to the leave balance. However, when a payroll system has annual leave in hours or days, the employer will need to increase or decrease the employees annual leave balance by the same factor as their hours change – so they continue to have the same balance in weeks.

Standard work week

For employees who work the same days and hours each week, it is easy to define what their ‘working week’ and annual leave entitlement. They can take 4 weeks paid annual leave, every 12 months on their anniversary for annual leave entitlement.

For example, if an employee works 4 days each week, they can take 16 days of annual leave (4 days x 4 weeks = 16 days). If they work 5 days each week, they can take 20 days of annual leave. This is processed the same when annual leave is stored as hours.

Irregular hours

It’s a little bit more complex for employees with irregular hours as it may not be possible to define what a ‘working week’ looks like in advance. They may not have guaranteed hours or work to a roster which changes from week to week.

Employers can look at the following factors:

- The extent of the week-by-week variation in days worked

- The extent of the week-by-week variation in hours worked

- The employee’s scheduled/contracted/agreed days and hours

- The difference between the scheduled weekly hours and average weekly hours (over an appropriate period)

This then creates three options:

- Create an average of the last 4 or 12 weeks

- Base this on the week in question

- The employer agrees with the employee on the portion of a week taken

Payment for annual leave

Employees must be paid the higher of their ordinary weekly pay compared to their average weekly earnings for the annual leave period. This includes regular wages and any regular allowances that the employee would have received if they had worked during that time.

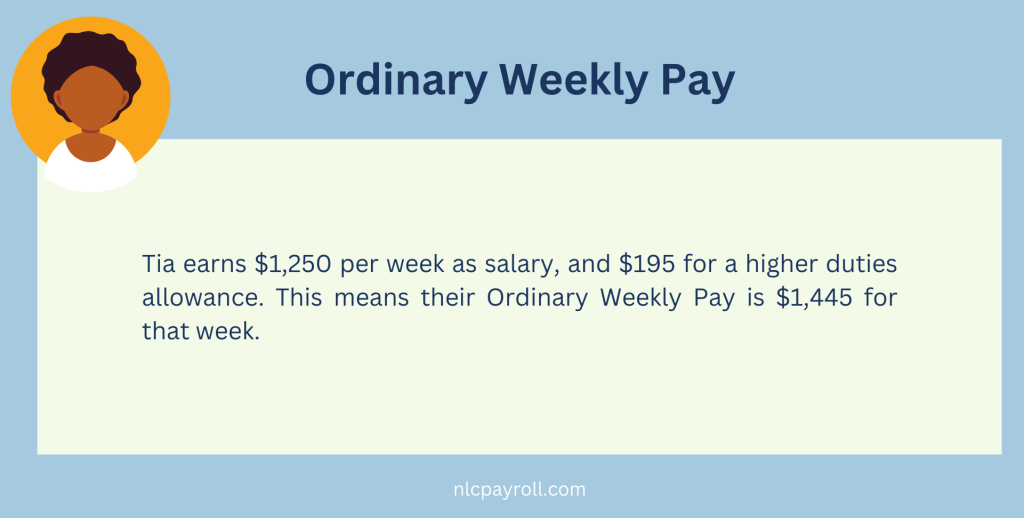

Ordinary weekly pay

Ordinary weekly pay is what the employee receives under their employment agreement for an ordinary working week. This includes allowances, overtime, productivity or incentive-based payments as long as they are regular.

Irregular / one-off payments / discretionary payments are not included in ordinary weekly pay.

Average weekly earnings

Average weekly earnings is 1/52 of an employee’s gross earnings for the 12 months prior to the pay period they take annual leave. Leave without pay or a new employee would mean average weekly earnings divisor can be less than 52 (weeks).

Parental leave

Taking parental leave does not affect an employee’s entitlement to annual leave and is considered continuous employment. While an employee is on parental leave their annual leave entitlement will continue to build, however the calculation for any annual leave that they became entitled to during parental leave, or within 12 months of returning will be affected.

Usually, annual leave is paid at the higher of ordinary weekly pay vs average weekly earnings – however annual leave that has been affect by parental leave is due to be paid at average weekly earnings only. Essentially if the employee has been back at work for half a year and take leave, their annual leave rate could be approximately half their normal hourly rate.

Many businesses have moved to paying above the Holidays Act, meaning they will still pay at least the employee’s ordinary rate.

Cashing up annual leave

If an employer has a policy that allows, it is an option for employees to request cashing up 1 week of their 4-week minimum annual leave entitlement each year, meaning they’ll get paid that money instead of taking that 1 week of leave. This can be one request for the whole 1 week, or multiple requests until the entire 1 week is cashed up. The employer must consider the cash up request and if approved, the cashed-up amount must be paid as soon as possible (i.e. the next pay period).

What happens when an employee is leaving?

When an employee leaves, they must be paid their unused annual leave entitlement. This should be paid at their ordinary weekly pay when they finish employment or their average weekly earnings for the 12 months up to the end of the last pay period before employment ended, whichever is greater.

Do public holidays impact annual leave?

Employees are entitled to a paid day off on public holidays if they would normally work on that day, regardless of their length of service. This does not impact their annual leave balance.

Looking for an easier way to do payroll? Our Outsourced Payroll team are here to provide fast, accurate and personalised payroll that will save you time and money – let us do the heavy lifting for you!

Disclaimer: The information provided in this article is for general informational purposes only and is not intended as a substitute for professional advice. Reliance on the information in this article is at your own risk, and it should not be used as a basis for making decisions without consulting a qualified professional.